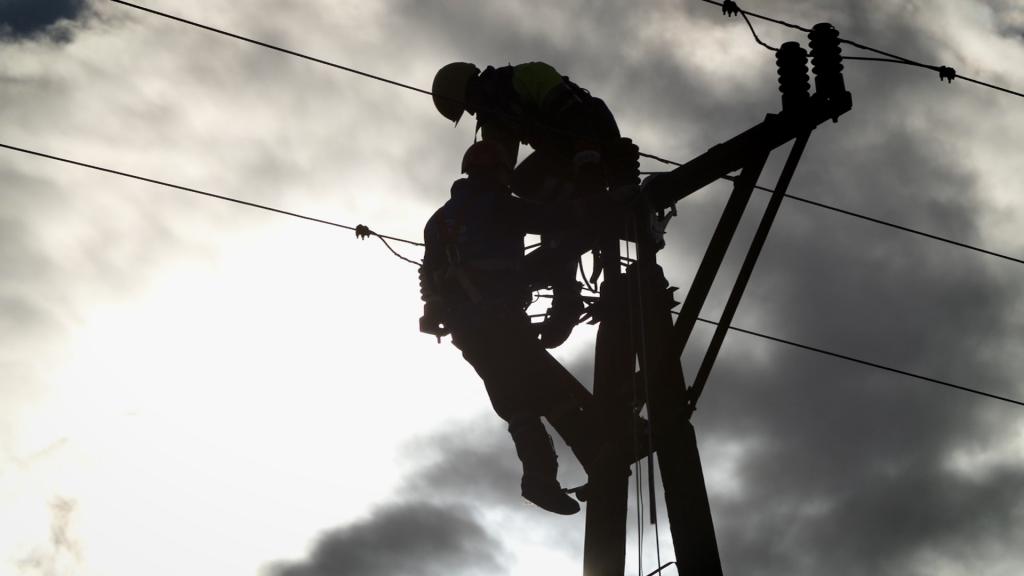

Distribution grids are the backbone of the digital and energy transition, as they ensure a continuous and reliable electricity flow, integrate the majority of renewable energy sources and enable the creation of new services for consumers. But to be fit-for-purpose in an increasingly decarbonised, decentralised and digitalised power system, there is an urgent need to ramp up investments in Europe’s distribution grids.

European distribution grids will need investments of €375-425 billion until 2030. That is the main conclusion of a landmark study conducted by the industry bodies Eurelectric and E.DSO. A first of its kind, the study which was carried out by Monitor Deloitte on the basis of detailed empirical data from 10 European countries, reveals a need to ramp up grid investments by 50-70% in the 2020s compared to the previous decade. At the same time, it highlights a range of remarkable societal benefits that come with timely modernisation of the continent’s electric infrastructure.

Key investment drivers: Renewables, electrification and old age

A significant part of the investment needs is driven by the ongoing energy transition: expansions and replacements related to integration of variable renewables such as solar and wind, 70% of which will be connected at distribution level, as well as to the progressive electrification of industry, transport and buildings.

The single biggest investment driver, however, is modernisation of the infrastructure due to ageing. The study finds that approximately one third of EU’s grids is already over 40 years old. This share is likely to surpass 50% by 2030.

Limited price impact and societal benefits

Despite investment needs for upgrading and developing distribution networks of €34-39 billion each year (an increase of 50-70% on 2019 spending), the impact of these activities on electricity prices and network tariffs is likely to be limited if policy makers and regulators provide the right regulatory framework as well as smart tariff systems.

Moreover, the societal benefits in relation to sustainability, economy and competitiveness, brought about by this transformation will outweigh the economic impacts: The EU could save over €175 billion in fossil fuel imports annually, and ultimately reduce the average electricity costs by €28-37 billion in the long term.

Additionally, the study shows some 90% of investments, or €30-35 billion of annual revenue, could be captured by EU manufacturers and service providers, contributing to the post-pandemic economic recovery. Overall, investments in distribution grids will sustain 440-620 thousand quality and local jobs per year in the EU27 and UK.

Upon the release of the study, Kristian Ruby, Secretary General of Eurelectric, said:

“Grid investments are urgently needed for the energy transition and they hold a huge potential for job creation. With the right framework conditions we can make the 2020s the decade of distribution grids. We call on policymakers to improve investment frameworks and tariff design, facilitate access to EU funds and accelerate authorisation and permit granting processes”.

Christian Buchel, Chairman of E.DSO, and Director for Territories, Customers and Europe at Enedis, concluded: “We own know-how and the technologies, IT and IA, to enhance the transition of the energy system. Nevertheless, we need decision makers, political bodies, citizens, regulators, financial institutions and NGOs to understand how essential it is to reach the requested high level of quality investments that we can assure”.

Note to Editors:

Methodology:

The study “Connecting the dots: Distribution grid investment to power the energy transition” conducted by Eurelectric, in cooperation with E.DSO, and with the analytical support and facilitation of Monitor Deloitte is the first European analysis assessing the investment needs in power distribution grids.

The scenario-based analysis assumes:

- 510 GW of new renewable capacity would be installed at EU27+UK level. Of those, over 470 GW will be represented by centralised solar and wind capacities, whereas 40 GW will be represented by self-consumption. The total cumulative capacity by 2030 is of approximately 940 GW.

- The cumulated annual growth rate of electricity demand is 1.8% in EU27+UK. Industrial and power-to-X demand would reach ~3,530TWh by 2030, while 50-70 million of EVs (20-25% of passenger cars fleet) and 40-50 million heat pumps will increase the electricity demand from the transport and buildings sectors.

In summary, network reinforcement will require investments of 375-425 billion euros by 2030. The estimate is based on empirical data provided by a consortium of 10 national associations and companies, providing a reliable geographical and technical breakdown. The countries covered are Denmark, France, Germany, Ireland and Spain, Poland,Portugal, Sweden, Hungary and Italy. Transformation and investment levels for each country are available at the link: https://www.eurelectric.org/connecting-the-dots

Information on Associations and contact details

European Distribution System Operators (E.DSO)is the key-interface between Europe’s leading DSOs and the European institutions, developing large-scale smart grid technologies, new market designs and regulation. E.DSO gathers 41 leading DSOs in 24 countries, including 2 national associations, How? By shaping smarter grids for your future.

- Juan Marco, Principal: [email protected], +32 (0)2 737 13 43

Eurelectric represents the interests of the European electricity industry. With members from more than 30 European countries, it acts on behalf of 3,500 companies in the sector of generation, distribution and sale of electricity. It strives to increase the competitiveness of the electricity industry, ensures effective representation in public affairs and promotes the role of electricity in social progress. Additional information is available at: eurelectric.org

- Ioana Petcu, Press & Media Advisor: [email protected], + 32 470 45 35 89