758 billion euros have been allocated by European countries to protect energy consumers from the effects of the energy crisis caused by Russia's policies and its aggression against Ukraine . Despite the unprecedented expenditure, energy prices in some countries even rose by more than 100%. Poland allocated a relatively small amount of funds for this purpose (equivalent to EUR 12.4 billion), but managed to contain the increase in energy prices more than in other countries. As a result, energy prices for end users in Poland are still among the lowest in Europe.

Experts from the Energy Market Agency, commissioned by the Polish Electricity Committee, analysed the shielding measures taken by European countries in response to the

for the energy crisis - starting in September 2021 and continuing until January 2023.

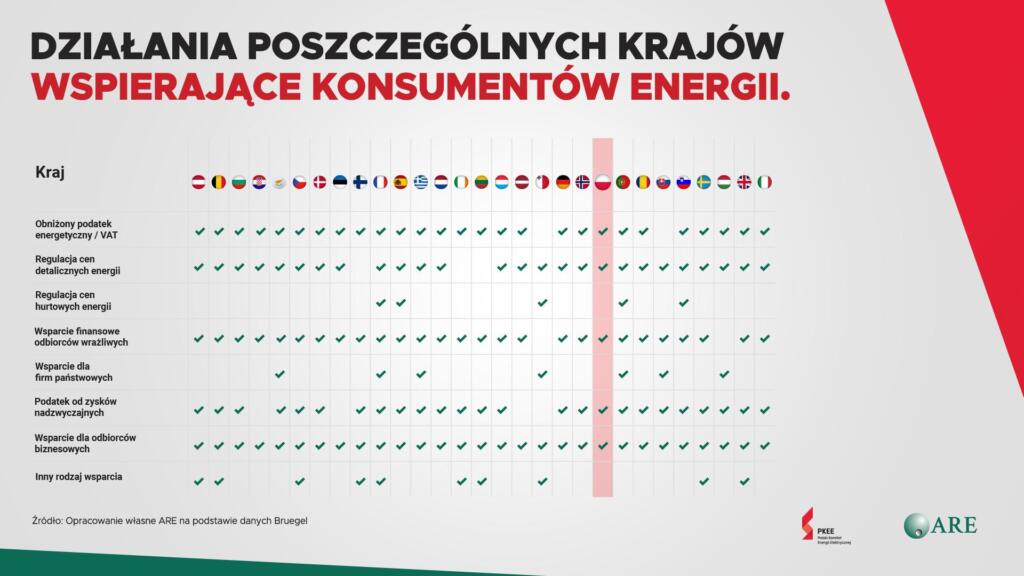

During this period, 27 out of 29 countries analysed applied reductions in VAT or energy taxes and cash transfers for vulnerable consumers. Most countries decided to regulate retail electricity prices, a windfall profits tax and support for business consumers. All of these solutions were also applied by Poland. Only a few countries decided to regulate wholesale energy prices and support state-owned companies.

"Poland has achieved one of the highest cost-effectiveness of the protection solutions introduced. The increase in electricity prices for households in our country was only 12.9%, while the expenditure on protecting individual consumers amounted to only about 2% of GDP. In the same period, France saw around 20% increase in household electricity prices at an outlay of around 3.8-4% of national GDP. These values in Germany were 40% and 7.5% of GDP, respectively, and in the UK 90% and just under 4% of GDP," says Andrzej Bondyra, vice president of the Energy Market Agency.

As he points out, Poland's success in containing prices was due, among other things, to Poland's electricity mix, which is still based on coal sourced from domestic mines. Therefore, Poland was less affected by the severe increases in global commodity prices observed in 2022.

"The Polish energy sector was relatively well prepared for the crisis. Thanks to the gas port

and the Baltic Pipe, opened in 2022, we are independent of gas supplies

from the East. Poland's coal-fired power industry primarily contracted raw material

from Polish mines. Disruptions appeared temporarily in the retail market, but were quickly met by intervention imports from other directions. The greatest pressure on the cost of electricity generation was exerted by the price of CO2 emission allowances, which increased dramatically in 2021," - adds Maciej Maciejowski of the Polish Electricity Committee.

In 2021, the EU ETS price rose from around €20 to around €80 per tonne and this high price - despite significant fluctuations in February and the summer of 2022 - has remained until now. This means persistently high costs for electricity generators in Poland, despite lower raw material prices than last year.

"At the end of 2022 and beginning of 2023, gas and coal prices on global markets have fallen slightly

and have stabilised, but remain significantly higher than just two years ago. In addition, power generators today bear the cost of purchasing raw materials on the futures market

in 2022 at the highest price levels," explains Andrzej Bondyra.

Prices below the European average

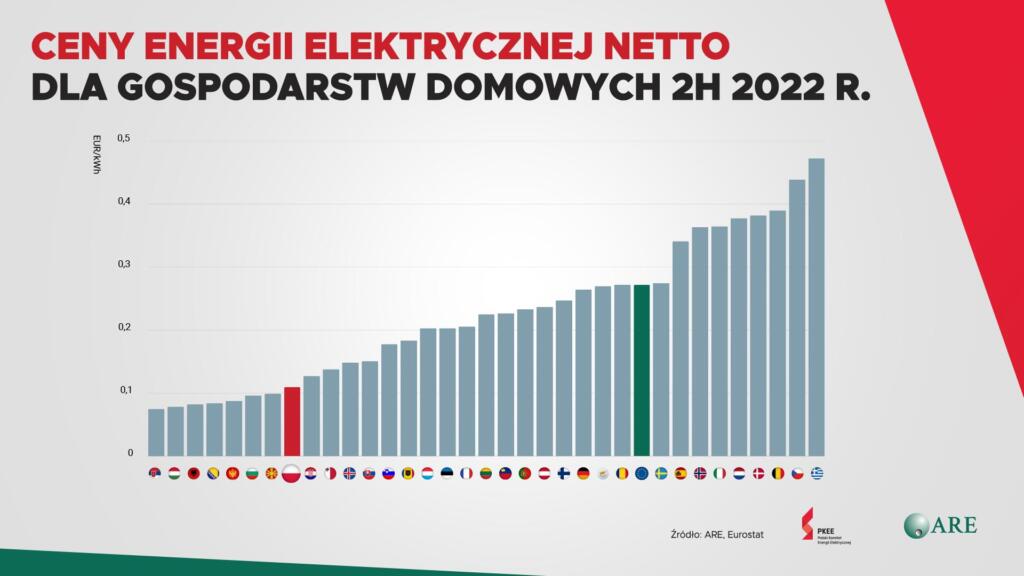

Despite the ongoing crisis, thanks to the protective measures introduced in Poland, it is managing to maintain relatively low - remaining significantly below the European average - energy prices for end consumers. In the second half of 2022, Polish households paid an average net price of EUR 0.1092 per kilowatt-hour, while the average for the European Union as a whole was almost three times as high - EUR 0.2716. Cheaper than in Poland was only

in some Balkan countries - Serbia, Albania, Bosnia and Herzegovina - and Hungary. The most expensive - more than 40 euro cents per kWh - was paid by households in the Czech Republic

and in Greece.

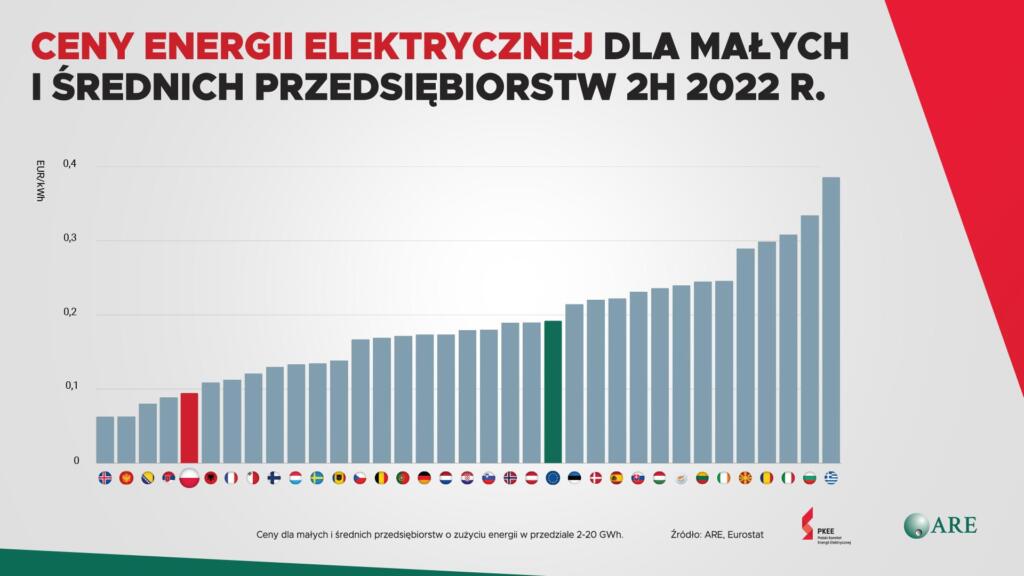

Also, prices for small and medium-sized enterprises (with a consumption of 2-20 GWh per year) during this period were among the lowest in Europe. In Poland, they paid an average of EUR 0.1084 net per kWh. Only Iceland, Montenegro and Bosnia and Herzegovina were cheaper. More than 30 euro cents per 1kWh had to be paid by companies in Italy, Bulgaria and Greece.

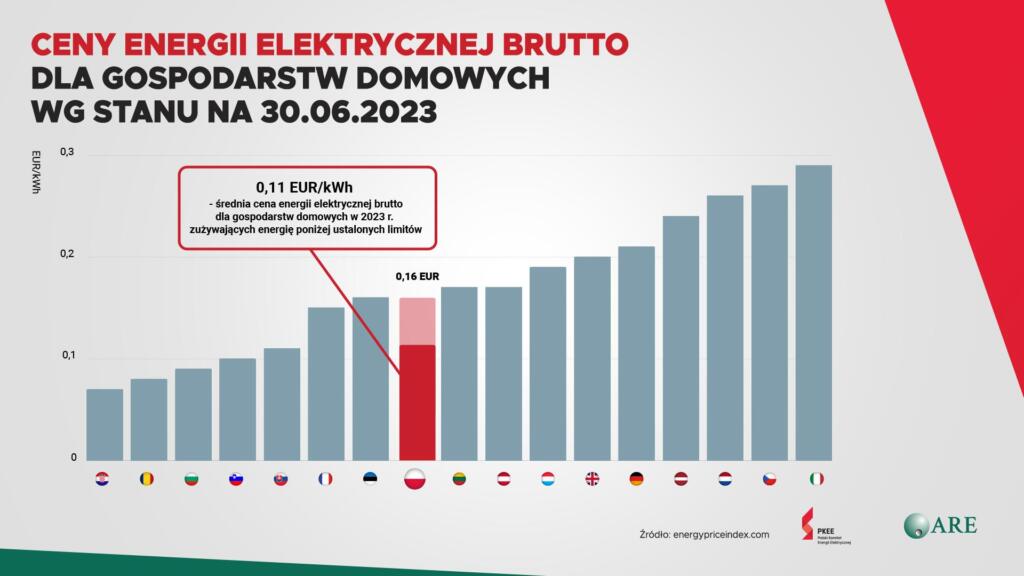

In 2023, energy prices in Poland for households remain below the European average. As calculated by ARE analysts, the average gross price (including VAT)

30 June 2023 was the equivalent of EUR 0.16 per 1 kWh in Poland. However, the calculation assumes that a household exceeds the consumption limit at the preferential price. Those households that fall within the limits already pay only EUR 0.11 gross for the whole of 2023.

"Over the past three months, the government has expanded the range of support identified

in the Solidarity Shield. Households have a 1,000 kWh higher energy consumption limit at a preferential price, plus the possibility to receive a one-off discount of PLN 125. In turn, small and medium-sized enterprises, sensitive consumers

and local authorities have been paying a new, lower price for electricity since 1 October," adds Maciej Maciejowski.

The current solutions in place to reduce energy prices for households, small and medium-sized entrepreneurs, vulnerable consumers, public institutions and local governments are in force until the end of the year. The government announces the continuation of the shielding measures in 2024. Detailed solutions are expected to be known in the fourth quarter.

Detailed information on shielding measures to stop energy prices rising is available at www.liczysieenergia.pl - the website of the Polish Electricity Committee's educational campaign, which aims to raise awareness of how to use energy rationally,

and thus reduce electricity bills.