By law, the electricity produced should be sold on the power exchange (barring statutory exceptions). Wholesale trading takes place on the forward and spot markets, where prices are determined by reference to the price offered by the most expensive generating unit covering demand at a given point in time (the so-called 'marginal price'). The current market price influences the price offered in the day-ahead market and in forward contracts, which already directly translate into prices offered by electricity sellers to companies, municipalities and institutions.

The energy market has been organised in such a way that energy produced by the units with the lowest variable cost of generation is fed into the electricity system first. This is the so-called 'merit order' rule. The greater the demand for electricity,

the more and more expensive generation units are committed to meet market demand. In turn, the lower the demand, the fewer units are needed in operation. This is why - according to market principles - electricity is cheapest when there is the lowest demand for energy, and the price rises as demand increases and more power plants are integrated into the system.

This mechanism is explained in an accessible way by an animation prepared by the Polish Electricity Committee, which can be viewed at https://liczysieenergia.pl/ and on https://www.youtube.com/watch?v=DdbAjRXYWRU&t=1s.

The exchange price of energy on an ongoing basis is determined by the most expensive unit operating

in the system, i.e. by the so-called marginal price. Energy at peak demand ("peak")

is therefore more expensive than off-peak ("off-peak"). Conventional power plants (coal- and gas-fired) can adapt their production to demand and market conditions within their technical capabilities. In contrast, the supply of renewable electricity is solely dependent on weather conditions - when the sun goes down or the wind stops, RES sources cease to produce electricity, so they must be replaced by coal- and gas-fired plants.

The cheapest electricity generating units on the Polish market are renewable energy sources. Their investment cost is relatively high, but the variable cost of energy production itself remains the lowest. More expensive in the comparison are units powered by lignite

and hard coal, pumped storage power stations, which also act as energy storage, and gas units, whose average generation cost is currently the highest. The high costs of coal and gas power generation are influenced by both the record high prices of these raw materials and the cost of purchasing carbon emission rights in the EU ETS.

Thanks to the so-called marginal price mechanism, renewable energy sources are being promoted throughout the European Union and, although they are dependent on favourable weather conditions, they are becoming a more profitable investment. Nuclear energy is also gaining in profitability, despite the costs associated with investment in this technology. The inclusion of the generation costs of the most expensive units in the system also ensures that their operation remains viable and not compromised. This is crucial to ensure energy security until coal-fired power plants are replaced by nuclear and renewables.

What influences prices

The level at which the marginal price is formed depends primarily on two factors:

- energy demand, i.e. current market demand - households, companies, institutions - the more energy we use, the more expensive the generating unit sets the price;

- the supply of energy from the cheapest sources - the greater part of the demand will be covered by RES

and the most efficient coal-fired power plants, the fewer expensive units enter the

into the system and the lower the energy price in the market.

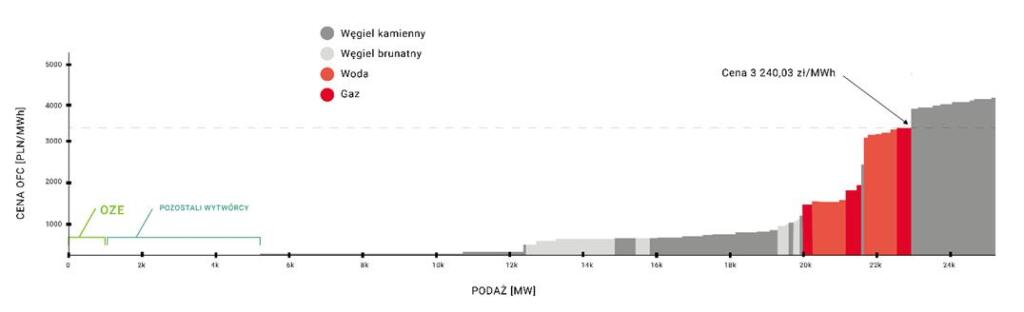

Example 1 -. low RES production, high consumption

Wednesday, 17 August 2022, 9pm

Low renewable energy production (only 711 MW) due to weather and time of day and high electricity demand of

22 837 MW meant that the price of energy was determined by gas units and amounted to PLN 3 240.03/MWh.

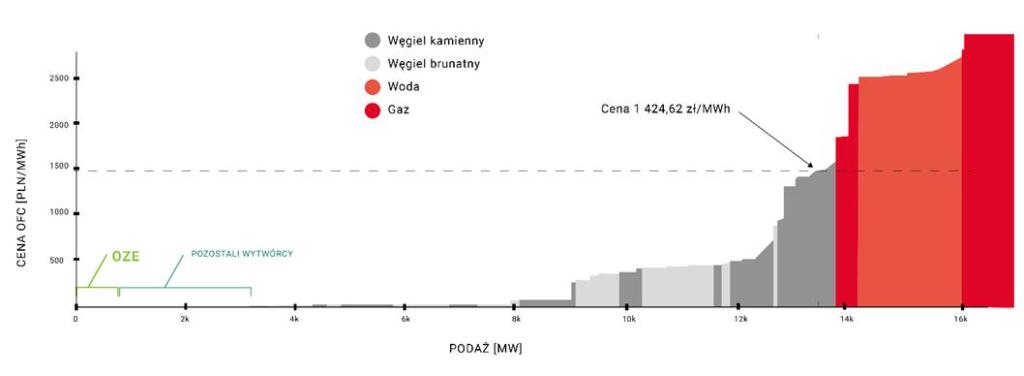

Example 2 -. low RES production, low consumption

Sunday, 28 August 2022, 6.00 am

The low production of renewable energy (only 513 MW) combined with the low demand caused by the early time of day at 1,137 MW meant that the price of energy was determined by coal units and was 1,454.62 PLN/MWh. Thus, the price was twice as low as in example 1. It is worth noting that an increase in demand by 1 000 MW would cause the price to jump to over 2 000 PLN/MWh.

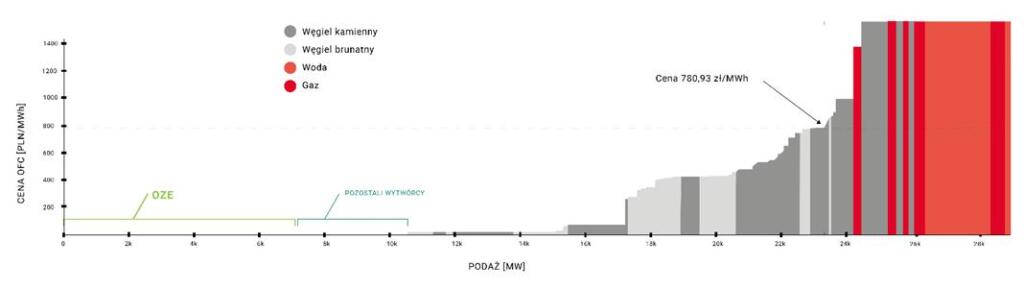

Example 3 -. high production from RES, high consumption

Friday, 19 August 2022, 2pm

With high energy consumption (23116 MW) and high renewable energy production

at the level of 7395 MW, the energy price was determined by coal units and amounted to 780.93 PLN/MWh. If, with the same production of energy from RES, its consumption was as in example 2...,

10 000 MW lower, the price of energy on the exchange would be in the region of several zlotys per MWh.

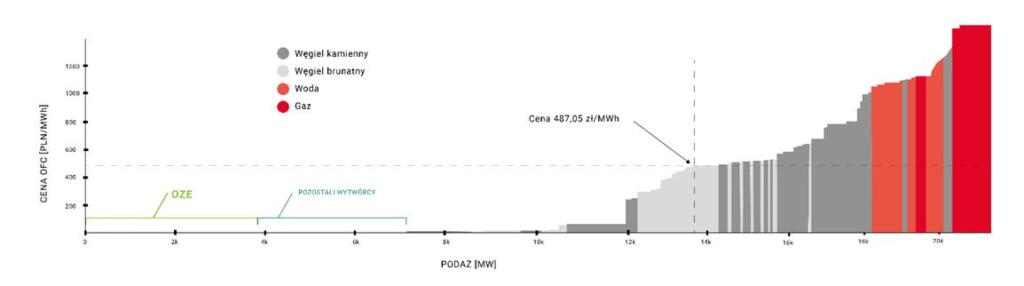

Example 4 -. high production from RES, low consumption

Sunday, 10 July 2022, 8.00 am

The relatively large amount of energy produced by RES (3,916 MW) and the fairly low consumption of

on Sunday morning (13 857 MW) meant that the price was set by lignite-fired units. As a result, it was at a relatively low level of just

487.05 PLN/MWh. This is more than six times less than in Example 1, where production from RES was much lower and energy consumption much higher.